Transform Your Credit.

Transform Your Life.

Expert Credit Repair Services

That Deliver Real Results

Bad credit doesn’t have to hold you back. Whether you're trying to buy a home, finance a car, or just gain peace of mind, our proven credit repair programs help you take control—fast.

BBB Accredited Business

Our Proven Credit Repair Process

We don’t guess we strategize. Here’s how we help you

take control of your credit and your future.

Setup & Credit Pull

We securely collect your basic information and pull your full 3-bureau credit report Free of charge. This gives us a clear view of your credit standing and where to start.

Review & Identify Issues

Our team carefully reviews your credit history with you to identify inaccurate or damaging items. You let us know what doesn’t look right—we prepare to challenge it.

Dispute & Optimize

We launch targeted disputes with the credit bureaus and creditors, while also helping you strengthen your credit profile with personalized strategies and expert guidance.

We’ve Got You Covered

90-Day money-back Guarantee

Not only does Certified Funding Experts offer true, legal representation, but we offer a best-in-class, 90-day money-back guarantee on Credit Cleanse.

Why Choose Certified Funding Experts.

With over 12 years of experience in credit repair, funding, and affiliate success, we know how to help real businesses grow and grow fast. From understanding the psychology behind financial decisions to creating fair, high-converting pricing systems, we’ve helped thousands take control of their credit, access the right funding, and scale confidently.

Here’s what sets us apart:

Expert-Led Credit Repair & Funding Solutions

Backed by deep industry experience and tailored strategies that deliver real financial transformation.Conversion-Driven, Compliant Pricing Models

Smart, transparent pricing built to maximize conversions, client retention, and regulatory alignment.Behavioral Marketing That Drives Action

Data-backed insights that turn curious visitors into loyal, paying clients.Systems Engineered for Scalable Growth

Proven operational frameworks that increase revenue, streamline delivery, and accelerate client results.

We don’t just offer financial services — we engineer success.

Choose Your Plan

STARTER CREDIT REPAIR PROGRAM

Our Starter Program is designed to address the most common credit issues holding you back. Whether you're preparing for a mortgage, car loan, or simply want peace of mind, we help you clean up your report and improve your score with strategic action.

Setup Includes:

Full 3-Bureau Credit Pull & Comprehensive Score Analysis

Customized Credit Improvement Plan Based on Your Unique Profile

Preparation & Filing of Initial Dispute Letters

Secure Access to Your Personal Client Portal

90-Day Money-Back Guarantee on Setup Fee

Monthly Service Includes:

Strategic Dispute Letters Sent to All 3 Credit Bureaus

Direct Creditor Interventions & Settlement Support

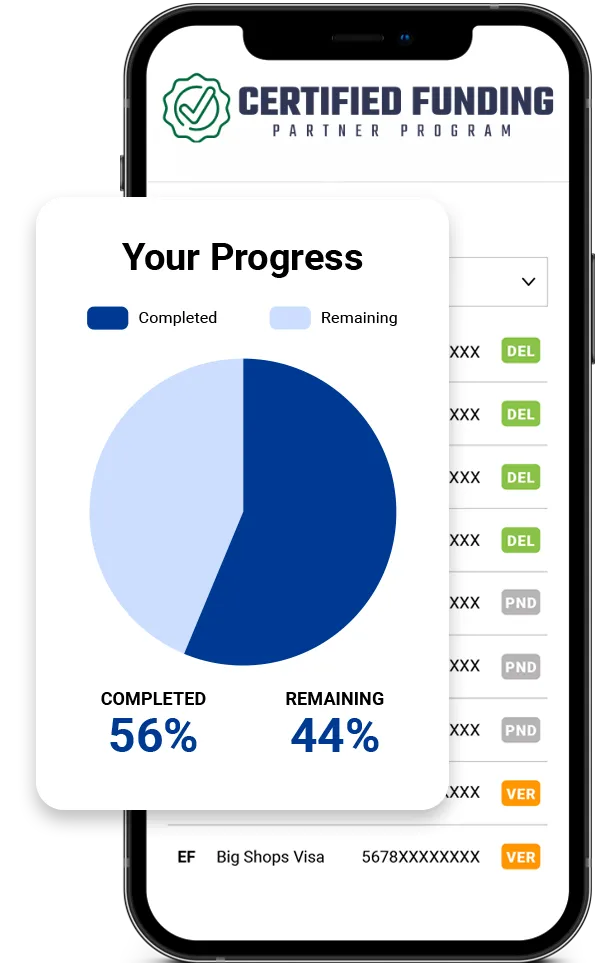

Real-Time Credit Monitoring & Progress Tracking

Ongoing Plan Optimization with Monthly Strategy Updates

Unlimited Phone & Email Support from Our Credit Experts

Setup Investment:

$350/One Time

Monthly Service: +$125 per Dispute Round

Client Success Stats:

Average 73-Point Increase in Credit Scores

68% of Negative Items Removed Within 6 Months

84% of Clients Qualify for Better Financing Within 90 Days

Individuals looking to correct credit report errors, build a stronger profile, and take the first step toward financial freedom.

PREMIUM CREDIT RESTORATION PROGRAM

Includes Everything in the Starter Program, PLUS:

Priority 72-Hour Dispute Processing for Faster Results

Dedicated Personal Credit Specialist for 1-on-1 Guidance

Advanced Dispute Tactics & Escalation Procedures for Complex Items

Comprehensive Identity Theft Protection & Monitoring

Unlimited Strategy Sessions & Phone Consultations

Tailored Credit Building Recommendations & Coaching

Ideal For:

Clients who need rapid credit restoration for major financial milestones

Individuals facing complex credit challenges or past identity theft

Those who value white-glove service, premium support, and real results

Setup Investment:

$350/One Time

Monthly Service: +$195 per Dispute Round

Results You Can Expect:

Faster dispute turnaround, deeper strategy, and stronger credit-building support — all designed to help you take full control of your financial future.

SUCCESS-BASED CREDIT REPAIR OPTION

Pay Only for Results That Matter:

No Monthly Fees While Disputes Are Ongoing

Only Pay When Negative Items Are Successfully Removed

Up to 18 Months of Active Credit Repair Engagement

Designed for Budget-Conscious Clients Who Want Guaranteed Results

Our Risk-Free Guarantee:

90-Day Refund Promise — If we don’t remove anything, your setup fee is refunded in full

No Contracts, No Hidden Fees

Cancel Anytime with No Penalty

Setup Investment:

$199/One Time

Non-Refundable

Success Fee: $35 per Negative Item Removed

Monthly Monitoring: $49/month

(Optional after completion)

Best For:

Clients who want a Results-First Approach to credit repair, prefer paying for outcomes—not promises, and want to avoid monthly service fees during the dispute phase.

Guarantee & Risk-Free Commitment

We believe in earning your trust and delivering results that speak for themselves.

90-Day Money-Back Guarantee – If you're not satisfied with your setup, we’ll refund you. No questions asked.

No Contracts or Commitments – Cancel anytime — no long-term lock-ins, no cancellation fees.

100% Transparent Pricing – What you see is what you pay. No hidden fees. No surprise charges.

Results Guarantee – If we don’t deliver, we’ll keep working at no extra cost until we do.

Business Line Of Credit FAQs

When Is a Business Line of Credit a Good Idea?

Due to the lower borrowing limit, shorter terms, and interest system, it’s best to use a business line of credit for short-term initiatives. Examples of when working capital needs a boost include ordering inventory, covering operational business services expenses for a month or two, or a lump sum for hiring more workers for a last-minute project. A business line of credit can help manage inventory during peak seasons.

What are the rates and fees for a Business Line of Credit?

Business line of credit rates and fees can vary widely depending on the provider, loan amount, and repayment term. Here’s what you can typically expect:

Interest Rates: Rates usually range from 7% to 36% APR. The exact rate will depend on your creditworthiness and the lender’s terms.

Origination Fees: These fees can range from 1% to 5% of the loan amount and are charged for processing the loan.

Maintenance Fees: Some lenders charge monthly maintenance fees, typically between $10 to $50, to keep the credit line open.

Late Payment Fees: If you miss a payment, you might incur late fees ranging from 1% to 5% of the outstanding balance.

How do I manage a Business Line of Credit?

Effectively managing a business line of credit is essential to maintaining your financial health. Here are some steps to help you stay on track:

1. Understand the Repayment Process and Terms: Know when payments are due and the amount required. This helps avoid late fees and negative credit reporting.

2. Make Timely Repayments: Always pay on time to maintain a good credit score and avoid additional fees.

3. Monitor Your Credit Limit and Available Funds: Keep track of how much credit you have used and what remains available.

4. Use the Line of Credit for Business Purposes Only: Ensure that all borrowed funds are used for business-related expenses to maintain financial discipline.

5. Review and Adjust Your Budget: Regularly review your budget to ensure you can afford repayments and adjust as necessary.

6. Consider Consolidating Debt or Refinancing if Needed: If you have multiple debts, consolidating them into one payment can simplify management. Refinancing might also offer better terms.

By following these steps, you can effectively manage your business line of credit and maintain a healthy financial position.

What Is a Revolving Line of Credit?

This is one of the first questions you should ask when seeking a credit line: Is the product revolving or non-revolving? With a revolving line of credit, paying back what you borrow makes those funds available again. As long as you continue to pay off your total balance, your terms and interest rate stays the same.

A non-revolving line of credit, on the other hand, does not replenish when you pay off the total balance. You borrow, pay it back, and then it’s gone.

Should I Get a Line of Credit or a Business Credit Card?

An unsecured business line of credit is like a revolving credit card with a higher borrowing limit and lower interest for business line of credit rates. Hence, this decision primarily depends on the cost of the expense at hand. Interest rates on business lines of credit are typically lower than those of a business credit card.

A business credit card might be better to cover a few minor, recurring expenses. You should pursue a small business line of credit to cover more considerable temporary costs. To clarify, a small business line of credit makes more sense when you regularly need extra cash for more substantial expenses. On the other hand, a business credit card is best for minor expenses that don’t increase in cost. In addition, you may avoid the credit card annual fee, although some lines of credit have draw fees or account fees.

Should I get a Business Loan or a Line of Credit?

Will a small business line of credit work for you? At United Capital Source, we’ve helped get revolving credit lines for hundreds of industries, from retail to landscaping to auto repair.

This option is probably your best if your company experiences seasonal fluctuations or inconsistent monthly revenue. When considering a small business line of credit, ask yourself these questions:

Do I need…

1. To make several quick investments instead of one long-term investment?

2. Flexibility instead of a fixed repayment schedule?

3. Quick access to funds?

If you answered yes to these questions, then credit business lines are probably the right choice for you.

Can I Get a Business Line of Credit with Bad Credit?

This product is available to borrowers with bad credit, but your borrowing limit may be lower, and your interest and terms will be less convenient – i.e., you might not get the prime rate for the product. However, if your cash flow is solid, poor credit may impact your borrowing limit, interest, and terms less.

We’ve repeatedly mentioned that the best time to apply is before you actually need the money. Thus, if you’re concerned about poor credit or business credit score impacting your borrowing limit or interest, you should improve your minimum credit score before applying. UCS even offers credit repair services for this exact situation.

What’s the difference between a Secured and Unsecured Business Line of Credit?

A secured business line of credit requires collateral to back up the loan, such as business assets or property. This reduces the risk for the lender, allowing for potentially higher credit limits and lower interest rates.

On the other hand, an unsecured business line of credit does not require collateral but typically has stricter eligibility requirements and may come with higher interest rates. Businesses must weigh the benefits and drawbacks of each option to determine which type of credit best suits their financial needs and risk tolerance.

Headquarters: 267 Langley Dr #1036 Lawrenceville, GA 30046

© 2025 Certified Funding Experts LLC. All Rights Reserved - Terms & Conditions | Policy